Agricultural insurance focuses on modeling the risk of crop yield damages due to natural or other disasters such as hail, heavy rain, flooding, extreme temperature, wind storms, droughts, etc. GEO Insurance focuses on modeling with deep learning the risk of crop yield loss using Earth Observation & meteorological data bundled with blockchain technology to ensure the transparency of the whole process from data to client information and reduction of administrative costs & process through automated verification.

Crop insurance is the farmer’s most important risk management tool. With uncertainty in crop production constantly looming, insurance is something secure; a safety net for the unpredictable. Profit margins for agri insurance companies are becoming narrower over time due to insurers needing to react faster and more precisely to the volatility and advancements in agriculture. Agri-tech is continually evolving and it’s essential that crop insurers evolve with it to remain reliable and progressive. Providing clients with advanced data and views of their fields is no longer a luxury, but an expectation that insurers use technology to help manage risk. Satellite imagery combined with meteorological datasets and models can help by increasing operational efficiencies, managing exposure to risk, and providing substantiated validation. Currently, climate change is happening, food security is becoming a global threat, thus the need was identified to create a platform that delivers information that helps create a sustainable, transparent, efficient, and scalable agri-insurance market.

Insurers are always looking for ways to increase efficiencies and lower operating costs, especially since farmers are constantly relying on the output. Satellite technology provides both historical and current perspectives of any local conditions versus needing to send team members out to scout every area. Imagine rather than having a new field to scout and having no reliable background, you have access to 30 years of reputable, historical field data. With this information, insurers can prioritize the necessary field visits and simplify the claims management process. The data also enables you to quickly and confidently validate loss adjustment claims with reliable third-party data.

In its recent history, the EU Common Agricultural Policy (CAP) has undergone several reforms towards greater market orientation, shifting from production support to mainly decoupled payments and less public intervention. It must be noted that crop insurance is obligatory for farmers receiving EU subsidies. This shifting had as a result public-private partnerships to be created all over Europe in the Agriculture Insurance Industry. This model is similar to the US and the rest of the world, hence there is a great pool of targeted customers that include well-established Insurance Providers of both the Public and Private domains, Underwriting Agents, and Brokers.

The Technology

Satellite imagery provides advanced levels of insight so insurance companies are able to plan and manage financial risk. Satellite technology, including remote sensing images and meteorological data, allows receiving near real-time updates of anything that’s occurring in the clients’ fields, providing the ability to monitor any severe weather conditions and properly manage cash flow to pay eventual indemnities, versus waiting to react to situations. Satellite imagery is also able to cover larger areas in less time to provide a complete overview of one’s fields. There are many factors affecting yield and plant growth and many ways to measure them, however, the best information comes from the plants themselves — think of them as tens of thousands of sensors per hectare. Satellite imagery is used to give the user an accurate and unbiased view of a crop’s status and potential, and therefore your business potential, by analyzing information directly from the plants. Satellite imagery can provide a greater view of agribusiness and what’s occurring in the client’s fields.

GEO University developed a platform that delivers information that helps create a sustainable, transparent, efficient and scalable agro-insurance market: GEO Insurance. Considering the current situation in the agro-insurance domain, GEO Insurance focuses on delivering insights and data that assist insurance companies and underwriters in a more efficient evaluation of claims and risk mitigation. This will be achieved by providing meteorological information, alerts and historical insights to insurance companies and underwriters for a more efficient evaluation of claims and risk mitigation.

The Challenge

Key part in the crop insurance market is the proper underwriting procedures an insurance company undertakes in order to accurately estimate the risks involved in the insurance contracts. The crop insurance contracts involve many parameters and insure a wide range of objects (agricultural machinery, farm infrastructure), people (health and accidents) and crops (yield production loss). The main problem GEO Insurance is addressing focuses on the crop aspect of the insurance contracts. Using satellite data (remote sensing and meteorological) and models, bundled with artificial intelligence, GEO Insurance produces accurate and localized underwriting information for specific natural disasters that insurance companies insure: Overheat, Frost, Extreme precipitation, Windstorm, Snow coverage, Floods, and Droughts. Apart from these risks, GEO Insurance also provides analytical historical climate variables and indices utilizing Copernicus datasets, which are downscaled to local level in order to provide information at parcel level.

The second part of the problem GEO Insurance addresses is part of the damage verification process. After a disaster happens, claims from the farmers start flushing the insurance companies. The insurance company faces a big challenge at that time, they need to prioritize the claims for their validity and perform damage assessment for the contracts. Thus the insurance company must within a short period of time examine hundreds or thousands of contracts (depending on their client base and spatial distribution). GEO Insurance helps insurance companies initially to prioritize the claims, i.e. to monitor with satellite technologies which specific parcels are affected by the disaster. This solves a huge administrative burden of the company. For specific cases like floods, GEO Insurance can also perform an estimate of damage, information that can optimize the way claims are handled by the insurance company.

Study Area & Data Exploration

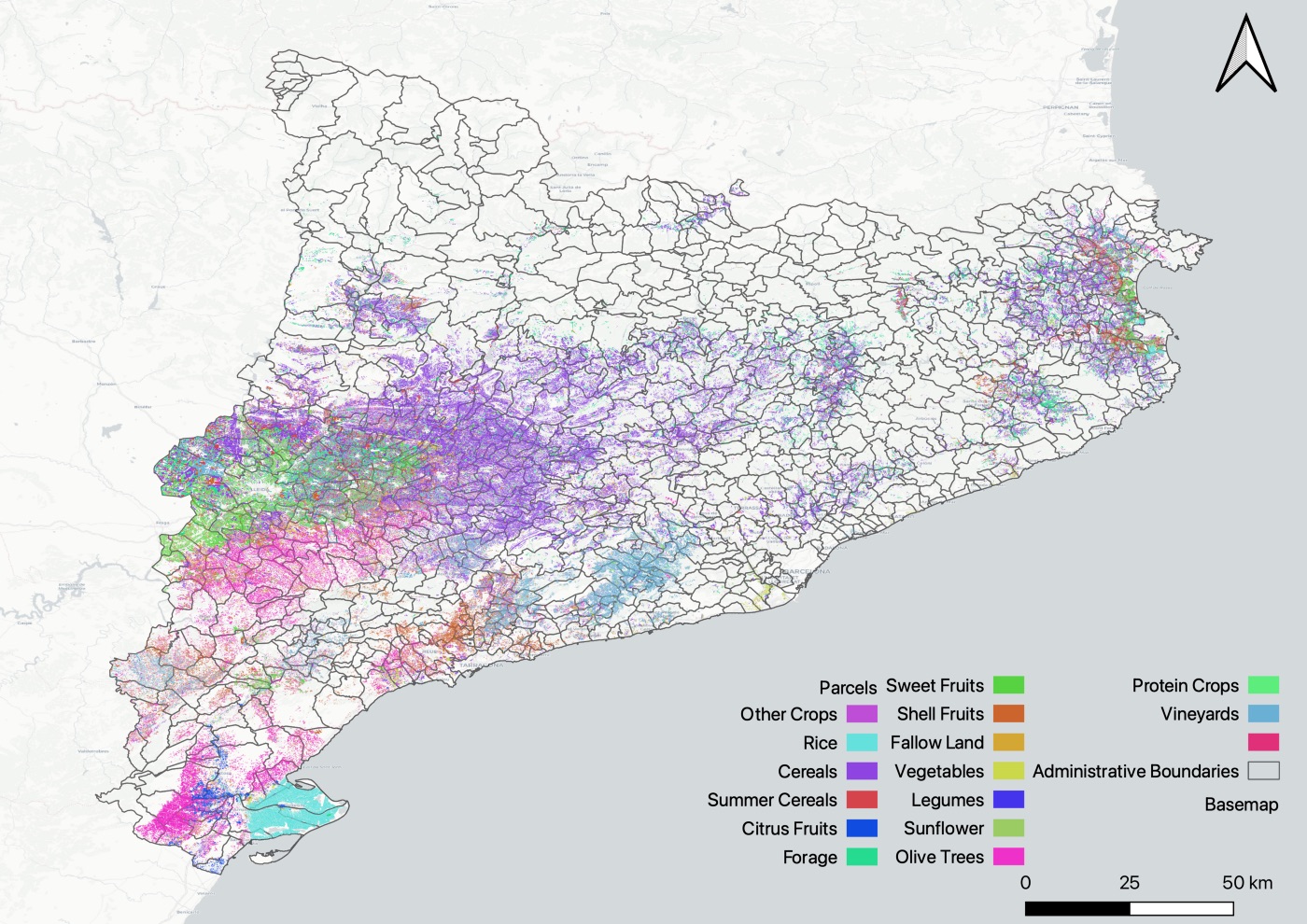

In this article, the GEO Insurance is applied to the Catalonia region of Spain. We utilized the farmer’s agricultural declarations [1–4] in order to gather the needed ground truth data to calculate the risks associated with crop yield production.

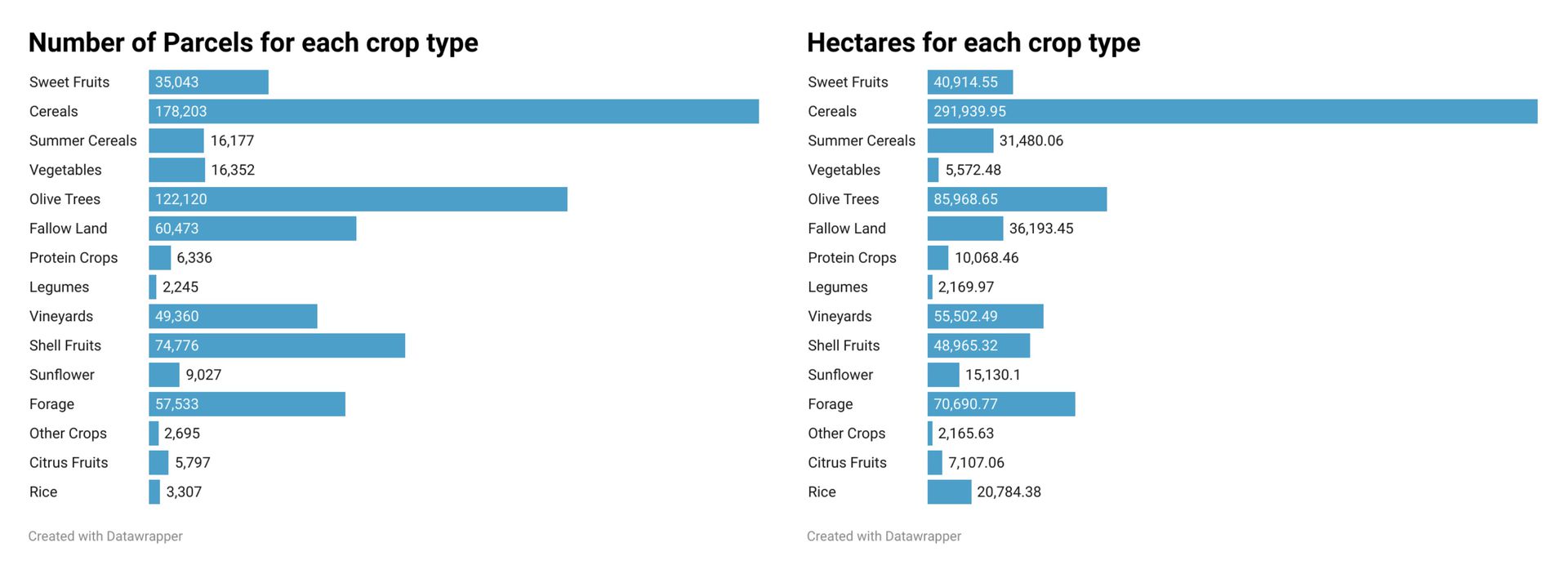

Catalonia mainly grows (in terms of area size) different types of cereals (40.6%), olive trees (11.9%), and sweet & shell fruits (12.4%).

Crop types are grouped as follows in order to simplify (for the article purposes) the process. In the map (Figure 1) the spatial distribution of the parcels is shown. The different colours correspond to the different crop types and are overlaid on the municipalities boundaries of Catalonia.

Before going to analyse the agricultural risks in Catalonia, let’s try to understand our dataset. Catalonia mainly grows (in terms of area size) different types of cereals (40.6%), olive trees (11.9%), and sweet & shell fruits (12.4%). It has significant areas for forage (9.7%). The rest of the crop types account for the remaining cultivated areas.

An important part of the analysis is also to understand not only the total cultivation area per crop type but also the fragmentation of those lands. For each crop type, we calculated the average parcel size (total cultivated area divided by number of parcels) and the corresponding standard deviation.

It is observable in Figure 3 that most crop types have an average size ranging from 0.5 to 2 hectares. Their variation is quite low ranging from 0.2 to 2.5 hectares. Rice on the other hand has much higher average parcel size (6.3 hectares) and standard deviation (8.8 hectares).

Risks

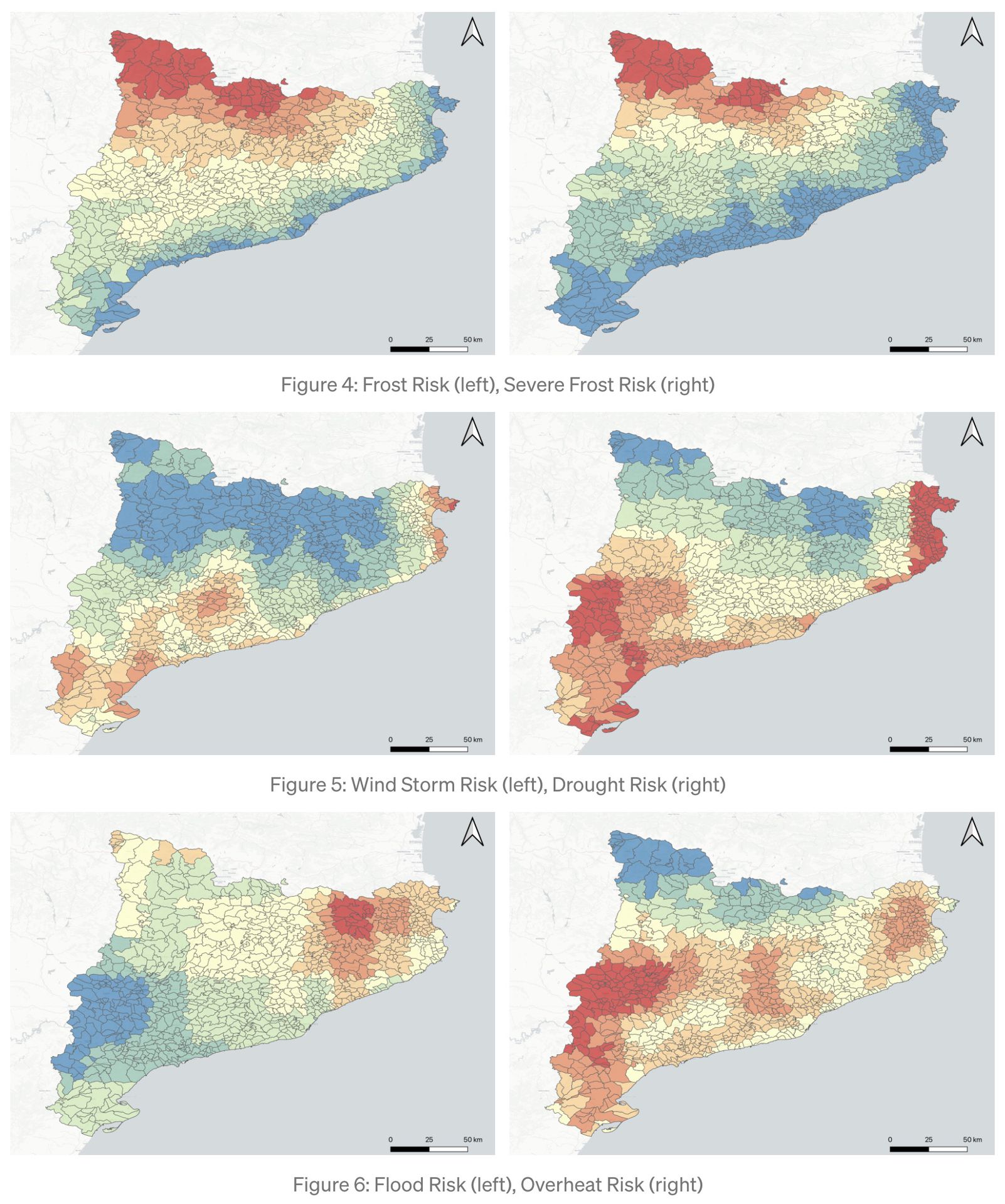

In our analysis, we have included the following risks that are mostly applicable in the area, which are only a subset of the risks that are produced in the GEO Insurance platform.

Frost Risk

Severe Frost Risk

Wind Storm Risk

Drought Risk

Overheat Risk

Flood Risk

Figures 4–6 present maps of the Catalonia regions divided based on the municipalities. For each municipality, a corresponding risk colour is assigned. Red is the highest associated risk, and blue is the lowest. The intermediate colours from blue to red have an increasing risk value.

Results

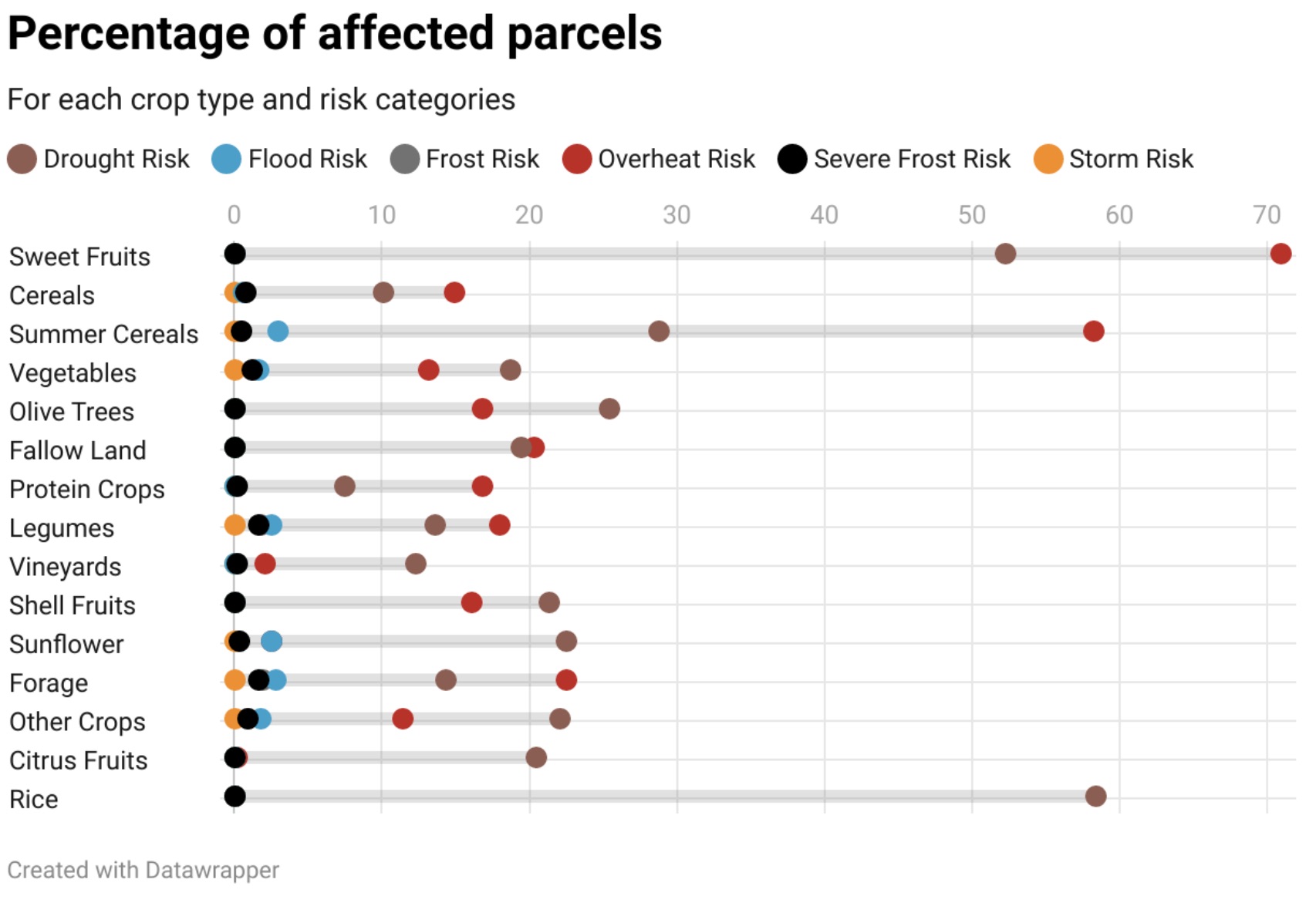

Taking into account the highest risks, i.e. red colour, and the distribution of the parcels and crop types, we computed the percentage of high-risk affected parcels.

Notably, 71% of Sweet Fruits are in high-risk overheating areas and 52% of them have drought risks, while the rest of the risks are close to zero.

This translates for an insurance company, that in the specific municipalities sweet fruits have a significant probability to be damaged by overheating and drought events.

For farmers and policymakers, this translates to higher operating costs (additional irrigation volume) and potential yield losses. Also, this introduces additional costs associated with risk mitigation measures.

Similarly, summer cereals and rice are highly affected by drought and overheating.

GEO Insurance Platform

The GEO Insurance platform is an online platform for insurance companies and farmers. Insurance companies:

estimate the risk of insuring new customers with their crops,

understand the risk and generate scenarios for your existing clients,

prioritise the claims and assess damages remotely, while minimizing field inspections.

Farmers:

get the risk of their cultivated crops at farm level

get alerts for potential natural disasters to plan their actions

generate damage reports with objective measures.

The generated value of GEO Insurance is to disrupt the way insurance companies understand and value their risks. Create a fair, transparent and affordable system to calculate crop insurance fees.

About GEO University

GEO University is a GIS and Earth Observation (GEO) group of professionals and experts in the corresponding fields. GEO University is dedicated to create and deliver knowledge to students, professionals, decision-makers and scientists who want to introduce or enhance their knowledge in these fields. The team of professionals and experts will guide you through the following topics:

Geographical Information System (GIS)

WebGIS

Remote Sensing/Earth Observation

Photogrammetry

The courses vary from simple note collections, books (for people who have constrained time to study) to complete lectures with exercises, quizzes (for people who are willing to dive into and extract the maximum value from the course). The courses are not only basic in the theoretical principles of each field, but we also create tutorial courses for specific open-source and commercial software. We constantly add and update courses so you get the best experience!

This article is part of the GEO Insurance platform developed by GEO University and cloudeo. Joint efforts with Vasilis Fotias and Anastasia Sarelli. Participation in Poster Session in Living Planet Symposium 2022.

References

[1] Government of Catalonia, Department of Agriculture, Livestock, Fisheries and Food, “Crop map with DUN origin in Catalonia,” http://sac.gencat.cat/sacgencat/AppJava/organisme fitxa.jsp?codi=4163, 2020.

[2] Dimitris Sykas, Vasilis Fotias, Anastasia Sarelli, “Risk and damage assessment platform for the agricultural sector based on EO data”, ESA Living Planet Symposium, Bonn, Germany, 23–27 May 2022.

[3] Dimitris Sykas, Ioannis Papoutsis and Dimitris Zografakis, “Sen4AgriNet: A Harmonized Multi-Country, Multi-Temporal Benchmark Dataset for Agricultural Earth Observation Machine Learning Applications,” IEEE International Geoscience and Remote Sensing Symposium IGARSS, 2021, pp. 5830–5833, doi: 10.1109/IGARSS47720.2021.9553603.

[4] Dimitris Sykas, Mara Sdraka, Dimitris Zografakis, & Ioannis Papoutsis, “A Sentinel-2 multi-year, multi-country benchmark dataset for crop classification and segmentation with deep learning”, April 2022. arXiv preprint arXiv:2204.00951.